by Felicien | Jan 7, 2019 | Education

In October of 2018, the San Diego Unified School District in California — the state’s second-largest school district — became aware of a severe data breach. As of now, the hackers are unknown, but officials are aware that through criminal means, the hackers were able to obtain the full names, addresses, and Social Security numbers of hundreds of thousands of students and staff at the San Diego Unified School District.

What Caused the Data Breach?

Officials investigating the San Diego school district data breach know that the breach was caused by a phishing scam. They are unaware of exactly when or how the phishing scam occurred, but in some way, hackers were able to obtain access to internal programs and systems in the school district (using a legitimate student or teacher’s login), and from there, they accessed and downloaded the personal information of over 500,000 students and staff members.

What Is a Phishing Attack?

A phishing attack or phishing scam is an illegally engineered attack that aims to obtain personal user data using fooling the target. A hacker will usually find out an account that a target or user group has.

For example, Hacker A might know that their target (an innocent civilian) has an account with Happy Bank in Smithsville. Hacker A will then create an email that looks almost exactly like a real email that would be sent out from Happy Bank. The email will be directed to the name of the target and say something like, “Hi, you need to update your account with Happy Bank. Please login using the following link.”

If the target decides to follow through with the email, they will likely click on the link provided, which will take them to a site that looks almost like the real site of Happy Bank. They will log in using their personal user data (email address or username and password), and probably after that, they will encounter some sort of error message.

By this time, the hackers will already have the user data or personal login information they need from the target. This user data is generally not the endgame for hackers, however.

This user data will merely be used by the hackers to access portals of a larger institution. Although some hackers may use personal login information for a bank, for example, only to steal funds from that person’s bank accounts, other hackers will take things to the next level and attempt to gain broader access and more personal and financial information. Sometimes, these tactics help hackers steal money directly; other times, hackers hold information ransom, extort cash with it, or blackmail individuals or companies by leverage things they know about them.

And remember that the Happy Bank example is just one example of a phishing email scam. Phishing emails and scams can come in many forms, and there are also phishing phone calls that can trip up many people and cause them to divulge personal and financial information willingly.

When Did the Security Breach Happen?

Unfortunately, as of now, the school district does not know exactly when the breach happened. Spokespeople for the school district say that the hack could have occurred anywhere between January 2001 and November 2018 (although the school district did not become fully aware of the breach until October 2018).

This is often the case with phishing attacks. Hackers first need to obtain access to a sensitive information system. To do this, they need login emails and passwords, and phishing emails are the ideal way to achieve this information.

What Information Were the Hackers Able to Obtain?

The San Diego Unified School District is the second largest school district in the state of California and currently serves over 121,000 students.

In this data breach, hackers were able to obtain a large amount of personal information from hundreds of thousands of students in the San Diego Unified School District. Select staff members were affected by the security breach as well, and of those affected, some were even students and staff going back to the 2008-2009 school year. Approximately 50 district employees had their login information taken or compromised.

According to officials, here is some of the additional information that was taken by hackers:

Staff and full student names, Social Security numbers, addresses, email addresses, personal information, and ID numbers

Emergency contact information from students and faculty, including full names, addresses, phone numbers, and email addresses, and employment information

Benefits information for staff members

Compensation and payroll information for staff members, including deduction and tax information, financial institution information (account numbers and routing numbers), and salary and paycheck information

Enrollment information about students, including their schedules, any legal notices, and transfer data on file, records of attendance, and health data

State ID numbers from staff and students

All of the staff members, district employees, and students who were affected by this data breach where notified. Accounts were reset, and cyber-security measures are being taken to prevent any additional breaches of data at the San Diego Unified School District.

How Can You Protect Your Business From Phishing Scams?

Phishing scams are the most notable (and unfortunately, the most effective) modern-day swindle in existence. Whether you own a business, manage or run an organization, or simply want to protect yourself and your family members from hackers, it is essential to learn about phishing emails and how to prevent them.

According to the VP of product management and strategy at Tripwire, Tim Erlin, “The best way to counter this technique … is to have complete and comprehensive logs from all systems.”

It is also vital that everyone in your business knows about phishing emails and how to spot them. Never click on emails or links that look suspicious or slightly “off.” If you are asked to go directly to a website to login via a link in an email, avoid doing so, and instead go directly to the website on your own to log in. Check your messages there for whatever was referenced in the email, or give the institution a call directly to inquire about the email.

Finally, if you own a business or run an organization, always employ the professional services of a high-end IT services provider who specializes in cybersecurity. They will put into place some strong security measures that will help you prevent any sort of security breach, including phishing scam breaches.

by Felicien | Jan 7, 2019 | Education

Downtime, compromised data, security breaches, and slow-running technology cause big headaches for today’s accountants. After all, you need your technology, and when it’s not working, every hour that goes by costs your firm money.

You can’t afford to sit idle—when your technology doesn’t work, neither do you. If your competitors use more efficient IT solutions, they’ll blow right past you and take your clients away. Or worse, your reputation will suffer.

Technology helps you carry out essential tasks, exercise professional judgment, engage with clients, provide advice, and settle tax issues. If you view technology as an opportunity rather than a threat, your firm will prosper and reap the rewards of your efforts. If you don’t, you’ll fall behind the competition.

You use technology now more than ever—at least, you should. Today’s technology is invaluable, and with time it will become even more so. In the past, the accounting profession lagged behind others in the adoption of new technology. They relied on paper-based filing and printed accounting forms that were time-consuming to process.

Accounting firms like yours have now embraced new technology. Just like other businesses, you need to streamline your services to save time and process accounting information. With modern technology like cloud-hosted accounting software, you and your clients can access data directly and simultaneously. The days of shuffling papers back and forth are over.

However, along with technology-provided benefits come some challenges.

Failed backups, slow-running email, application problems, and operating-system crashes create headaches that set up barriers to your success.

Downtime is a threat—it results in a significant loss of productivity. You can’t afford to be faced with server failures, poor systems performance, accidental file deletions, or software application crashes. Without access to your data, you and your employees can’t do your jobs. Money goes out the window, and you can’t meet your filing deadlines.

Data security is another issue that can cause significant headaches. Client confidentiality is your most important duty. But with hackers and intruders who want to infiltrate your technology for their own financial gain, your technology landscape is like a minefield unless it’s adequately protected.

As a Chartered Accountant, you are governed by Rules of Professional Conduct that always have and will continue to guarantee the privacy and confidentiality of your clients’ personal information. If their financial data is stolen, you’ll face penalties, fines, and possibly civil prosecution. You can’t take that chance.

THE ANSWER IS TO CONTRACT WITH THE RIGHT IT SERVICES PROVIDER.

To prevent IT headaches, you need service and support from an IT provider who understands the Line of Business (LOB) applications you use including your financial preparation and planning software and billing systems that keep your operations efficient.

The right provider can ensure these seamlessly incorporate with other applications you use like Microsoft Office or Office 365. When you have access to expertise from an IT Service Provider who truly understands your needs, you can effectively leverage these powerful tools.

Look for an IT Service Provider who has been serving the needs of accounting firms and corporate accounting departments for years. The best choice is one who can cover a broad range of technology requirements through both professional services and Managed IT Services and who can grasp the complexities your accounting firm faces.

They should be able to help you avoid IT headaches when automating routine accounting processes, sharing financial files, deploying mobility solutions, and capitalizing on tools like electronic filing.

Your accounting practice requires a complete technology management solution including data protection and proactive monitoring of all critical functions on your network, servers, and workstations. Plus, you should insist upon a fixed-cost solution with predictable budgeting. Just as your accountants are committed to your clients’ success, your IT Service Provider must be dedicated to making you successful and view themselves as an extension of your practice.

Your IT Service Provider should be adept with:

Cloud Technologies that improve your productivity, efficiency, and security

With cloud solutions, you can eliminate the cost of paper and the hassle of sifting through files, store massive amounts of information (Big Data), share important files in real time and secure your clients’ information offsite in high-security data centres.

Accounting Practice Management Software that helps you run day-to-day operations including the centralization of client data, tracking due dates, staffing, workflow management, automated billing, and time tracking

Tax Preparation and Filing Software designed explicitly for accounting firms, so you can analyze different income tax scenarios and have access to the reporting tools you need for fast, easy reconciliation

THE WORST HEADACHES RESULT FROM IT SECURITY BREACHES.

Data breaches are increasing exponentially. Cyber mafias have set up in towns like yours, operating from legitimate-looking offices. Hackers are no longer kids in their parents’ basements working on a few computers. Cybercrime is an international and sophisticated business with cartels operating around the globe.

Your data is valuable, and your accounting firm is a target. You need the expertise of an IT Service Provider who stays up to date on the latest threats. It’s imperative that you protect client information. But IT security best practices change so rapidly that accounting firms often find themselves falling behind the curve. If you do, your firm is at risk of viruses, network vulnerabilities, and data breaches. This results in more than a headache; now, you’re looking at a migraine.

Criminals have many ways of stealing your data.

Internet Exploits

Your employees use connected devices to interact with, track, monitor, and simplify just about every area of their work and personal lives. However, these technologies also provide access to sensitive, confidential information and present a wide variety of new security issues for attackers to exploit.

Third-Party Attacks

Cybercriminals have learned that contractors and other third-party providers aren’t as secure as large vendors, and lower security provides a pathway into otherwise-secure networks. Examine who can connect to your network and access confidential information, even if you believe appropriate security measures are in place.

Social Media Attacks

Social media presents two main security headaches:

A website you visit or service you use can be infected with malware that spreads until your network is ripe for a data breach. Malicious social media content is expected to grow 400 percent as attackers continue to distribute their malware and steal client data.

A determined hacker or team can scrape social media sites to assemble a surprising amount of personal data very quickly. This data can be used to engineer an attack.

Social Engineering Attacks

Human nature is easily the weakest link in any security chain. Was that really a utility-company employee you held the door for this morning? Are your office painters propping open a secure entrance to make their task more manageable? Did your receptionist just give all your passwords and hers to someone who called claiming to be from tech support on another floor? Will your colleague’s curiosity causes him or her to insert the USB key “found” in the parking lot into a computer connected to your systems?

Mobile Malware Threats

Security experts have been warning us about mobile malware threats for a long time, and users have grown immune to these warnings. Mobile-device use is increasing, as is the sophistication of attacks. At the risk of being the boy who cried, “Wolf,” every year a major mobile malware attack is more likely to occur. Attackers typically select the most significant number of potential victims. So, they will target mobile devices, specifically Android and jailbroken iOS devices.

Sophisticated DDoS Attacks

Distributed Denial-of-Service attacks don’t directly steal your information. Instead, they overwhelm your site or service with so much traffic that it prevents legitimate users from connecting. These attacks have evolved beyond simple flooding of traffic. They probe and then morph, based on the defences in place on your network. Such advanced and sophisticated attacks can seriously impair your accounting firm’s operations.

TO PREVENT THESE SECURITY HEADACHES, YOU NEED A SECURITY PLATFORM WITH REMOTE-ACCESS MONITORING AND RELIABLE BACKUP AND DISASTER-RECOVERY SOLUTIONS.

Be sure your IT Service Provider implements innovative, up-to-date security measures to protect your accounting firm against intruders, malware threats, and disasters. And ensure they can do the following things

Ensure:

You comply with accounting and confidentiality requirements when using technology.

You use appropriate technical means to minimize the risks of disclosure, discovery, or interception of communications.

Data and email are encrypted to protect your sensitive information.

You adopt management practices that offer protection against disclosure or discovery of electronically transmitted messages.

Prevent:

Unauthorized access to your electronic data

Computer viruses from damaging your data

Natural or manmade disasters from affecting your IT operations

Confirm:

Your files are reliably backed up and recoverable.

Both offsite and onsite data backups are maintained.

Data is restorable by performing ongoing testing.

Provide:

Systems Analysis

Mobile Device Management

Up-to-Date Security Solutions

User Support and Training

Your IT Service Provider should implement a security platform with multiple layers of protection, with 24/7 remote monitoring to detect infections and intrusions, and block them before they get in and steal or hold your data hostage. Many accounting firms are unaware that this goes on. Your IT provider will keep you informed and train your staff to recognize threats, so you know what to do if one comes across your computer screen.

Your very most basic security solution should include barriers with virus and malware detection at the firewall level and DNS (Domain Name Server) controls to ensure your users don’t visit hijacked websites. Your employees should also utilize two-factor authentication access practices to prevent criminals from getting into your network.

Nothing is more important than protecting the information on your network and the peace of mind that comes from knowing you can fully recover if a disaster hits your firm. Your IT provider must ensure your business continuity and disaster recovery solutions will meet your objectives and must implement a robust backup and secure off-site replication solution.

While computer systems can easily be replaced, the intellectual property and sensitive information stored on those systems cannot. Computer hard drives can fail, laptops can be stolen or lost, and data can be erased due to human error or viruses. It’s important for your accounting firm to have a backup system to keep data safe and avoid data loss.

Ask your IT Service Provider if they employ system virtualization and a private cloud with a fully redundant system that can be replicated across multiple data centres. If your data is compromised or damaged, a new clone of your system and data can be spun up with a new, fresh image in a manner of seconds.

Be sure your IT provider uses an Intrusion Detection System. This will catch anything that may have bypassed your firewall. They can either be used to find a break-in attempt in progress or detect one after the fact. In the latter case, it’s too late to prevent any damage, but at least you’ll be aware of the problem.

If an intruder gets into your system, the first thing they typically do is install a “rootkit.” A rootkit is a script or set of scripts that can make changes to your IT system and hide in common system utilities. They function in the background without your knowing they are there. Criminals can easily obtain these on the Internet. This is one reason you must have reliable backups of your entire IT system. If rootkits are discovered, you’ll need to re-install your system and data and start over from scratch.

Your mobile devices also require monitoring and management. If a phone or laptop is stolen, you must be able to remotely wipe your confidential data. Mobile Device Management also prevents disgruntled employees from leaving with your confidential or proprietary data.

Your IT Service Provider should also employ encryption to protect your confidential data. They should encrypt both your emails and data files to ensure the security of information. Encryption can protect your data at rest, such as on laptops or portable servers, as well as data in motion, such as over wireless networks or the Internet.

One of the most overlooked security aspects in accounting firms is their creating and retaining policies regarding email and data. You are accountable for instituting and employing a strategy that details the duration over which your client data and emails will be stored and deleted. Ensure your IT provider can implement automated solutions to handle this.

IN CONCLUSION

You understand the unique challenges and technology demands your accounting firm faces. Whether your IT headaches come from the security risks of handling and storing confidential information or the difficulties of keeping up with new, innovative Line of Business Solutions, you need an IT Service Provider who can ease your struggles and your IT headaches.

by Felicien | Jan 6, 2019 | Education

If there’s a will there’s a way when it comes to scammers, especially with gift cards. Everyone loves gift cards. Consumers love how easy it is to purchase gift cards, use gift cards and even give gift cards. It’s as simple as buying a card at a brick and mortar store or clicking a few buttons and almost instantly having the funds needed to play. Scammers love gift cards too. Gift cards can immediately be activated and spent by these scammers even before the owner of the card knows what happened.

Google Play gift cards are targets right now. Scammers love how easy they are to steal so consumers need to stay one step ahead of these online crooks. Here’s one of the latest Google Play Gift Card Scam that is scouring the internet.

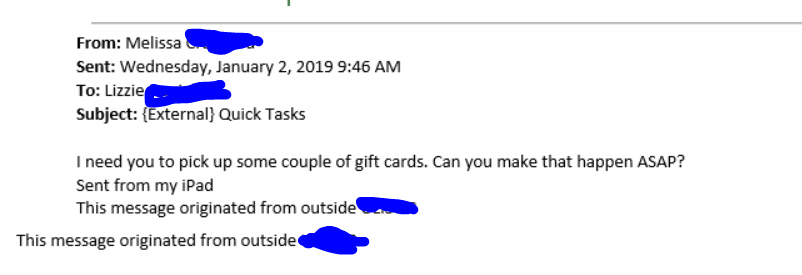

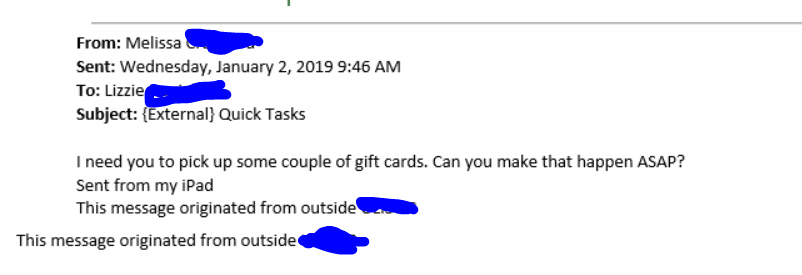

Scam Alert: Currently there is an email scam occurring where thieves, posing as someone the recipient knows and are phishing for personal, financial, and other private information. This includes requests for Google Play Gift Cards. For example, the message will read, “I need you to pick up a couple of gift cards. Can you make this happen? The type of gift card I need is Google Play gift cards. I need 4 cards in $500 denominations…scratch the back of the card to reveal the card codes and email me the gift card codes.”

Take away: Never provide any personal information including gift card codes like Google Play in an email. What seems like the information is going to a trusted source, it could be a scam.

by Felicien | Jan 4, 2019 | Education

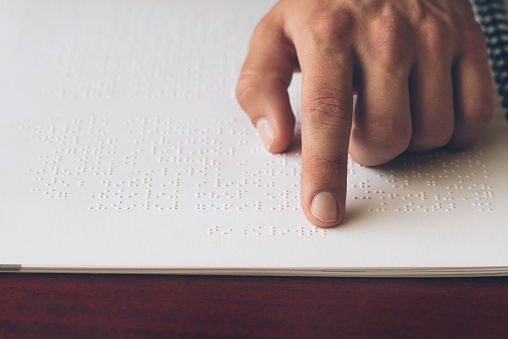

On January 4th, 1809, Louis Braille was born. Louis Braille was a child who lost his vision in an incident involving a sharp tool at the age of 3. During his early life, Louis had an interest in “night writing”, a military code used by the French Army in the 1800s. This “night writing” was a way for soldiers to silently communicate in the dark. At 15 years old, Louis Braille simplified the French soldiers’ code so that it was easier to use and understand. This was the beginning of the Braille System that is still used today.

Braille is a system of raised dots that are felt with fingertips to give blind people a way to read the words around them. The raised dots are arranged in a way that represents letters, numbers, and other characters. There are two different versions of Braille. The first is uncontracted, where each word is spelled out. The second is contracted, similar to shorthand. There is also a type of Braille, the Nemeth Code, that is for working with mathematics.

World Braille day reminds us of the impact that Braille has on the daily lives of people living with blindness. Braille is a key factor in obtaining literacy equality. Without braille, people with blindness or vision loss wouldn’t be able to read anything on their own. Braille helps people to live more independently.

On World Braille Day, further, educate yourself on braille. Learn about all the ways that it makes life easier for those who are blind. You could even join groups that help incorporate Braille into more parts of everyday life.

by Felicien | Jan 4, 2019 | Education

You are driving along and you glance down at your smartwatch. Imagine the horror of it when you hear the sirens wail directly afterward — but you think that can’t be for you: you were not driving over the speed limit. But it can be for you. The police saw you glance at your smartphone, and now you are facing potential license suspension.

It’s here: stricter distracted driving rules in Ontario have the potential to be quite devastating. Here’s what you should know about the new law that took effect on January 1, 2019.

What is the new distracted driving law in Ontario?

The new distracted driving law in Ontario is not necessarily new in the sense of what is considered distracted driving, but new in terms of beefed up penalties. If an officer suspects that you are driving while distracted, then you can be pulled over and cited. The police, however, cannot seize your driver’s license on the roadside. Your case will go before a judge, and upon conviction, you will have your license suspended as well as be subject to fines and demerit points.

What actions are considered distractions according to the new law in Ontario?

When we think of distractions associated with a distracted driving law, we most often think of our smartphones, but there are many other distractions that can result in a conviction. In fact, anything that causes a driver to be less focused on the road is a distraction to driving. The list of distractions according to Ontario’s Ministry of Transportation include the following activities:

Holding an electronic device — like a smartphone, iPad, tablet, iPod, or another device;

Using an electronic device to text, talk, send posts on social media outlets, type in addresses into the GPS or look at maps or control playlists;

Eating; and/or

Reading books or documents.

Further, if you think you can be safe using your electronics at a traffic light or any other time while in stopped traffic, you are wrong. It is not permitted according to this law to use your electronic devices while stopped. You can, however, use the following:

A hands-free electronic device that utilizes technology like Bluetooth and requires you to only turn it on or off; or

A mounted electronic device — whether it’s a phone or GPS system — so long as it is secure and does not move while you are driving.

The only exception to the new law is if you need to contact emergency personnel, like the police, fire department, or medical professionals.

What are the new penalties for distracted driving in Ontario?

Distracted driving has already been an offense in Ontario, but the new law strengthens the penalties to make it more of a deterrent than what it had been. Penalties vary according to the conviction: whether or not you have any prior distracted driving offenses. Plus, aside from the penalties, you can expect your auto insurance rates to increase dramatically. The stakes, therefore, have just multiplied with this new law.

First Distracted Driving Conviction Penalties

For a first distracted driving offense, you can expect the following penalties:

A fine of up to $1,000

Three (3) demerit points

A three (3) day driver’s license suspension, unless you have a graduated license, like a G1- or G2, then the license suspension is for 30 days.

Second Distracted Driving Conviction Penalties

For a second distracted driving offense within five years, you can expect the penalties to double:

A fine of up to $2,000

Six (6) demerit points

A seven (7) day license suspension, unless you are a G1- or G2-license holder, then the license suspension is for 90 days.

Third Distracted Driving Conviction Penalties

For a third distracted driving offense within five years, the penalties increase progressively, and include:

A fine of up to $3,000

Six (6) demerit points

A thirty (30) day driver’s license suspension, unless you are a G1- or G2-license holder, then your license could be canceled — and it can be difficult to get the license back.

Subsequent Distracted Driving Conviction Penalties

For each new conviction, fines and driver’s license suspension increases. You could potentially — if you become a repeat offender — be looking at driver’s license suspension up to two (2) years and fines of up to $50,000.

What to Do When Driving on the Roads in Ontario

There is a reason behind the new law and that is safety. The following are some statistics provided by CAA that you should keep in mind:

“Drivers engaged in visual-manual interactions with cell phones (e.g., texting) are up to eight times as likely to be involved in a crash.” (AAA, 2017)

Twenty-seven percent “of fatal crashes in BC was due to distraction. Police across Canada say that distracted driving has caused more collisions than impaired drivers.” (ICBC, 2016)

Thirty-three percent “of Canadians admit they have texted while stopped at a red light, despite believing it is unacceptable.” (CAA, 2016)

These are serious statistics. The obvious way to prevent the above from happening and from you obtaining a distracted driving citation and subsequent conviction in Ontario is simple: don’t use your electronic devices while driving, but also, don’t eat, read, or write, or even groom yourself by putting on makeup or brushing your hair. Refraining from these activities can help bring down the above statistics and can help make our roads safer.